Capturing Opportunities across Economic Cycles

優化組合 駕馭多變經濟形勢

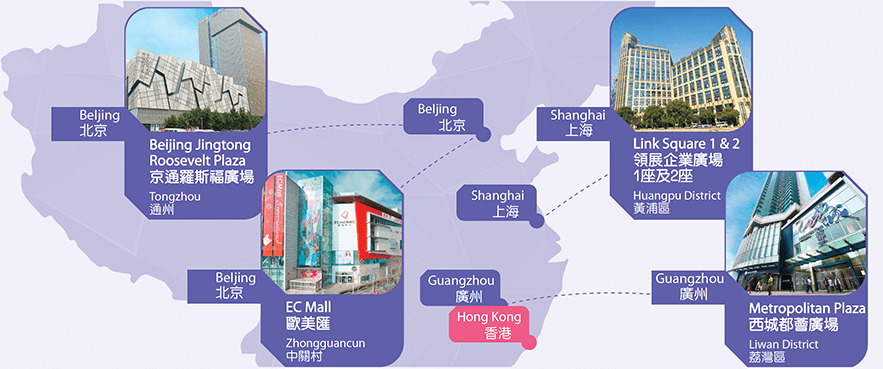

2018 ended with Link achieving key milestones through two important transactions ─ the acquisition of Beijing Jingtong Roosevelt Plaza and the divestment of a portfolio of 12 properties.

Marking our fourth investment in mainland China, Beijing Jingtong Roosevelt Plaza is located in Beijing’s fast-growing sub-centre of Tongzhou. It underscores our team’s ability to identify well-located, high growth assets.

Moreover, our recent divestment exercise achieved a 32% premium over appraised values, signifying Link’s continuous efforts to enhance portfolio quality through capital recycling, as well as global investor confidence in Hong Kong economy. The buyer of the divested portfolio was a consortium led by Gaw Capital Partners. As leader of another consortium that acquired 17 assets from us in November 2017, Gaw Capital Partners is already familiar with our community-based retail portfolio, and we are confident in their ability to create value for stakeholders.

The assets we have acquired in recent years are bigger assets with stronger growth potential than those we disposed. The performance of our mainland acquisitions is particularly noteworthy, as demonstrated by the reversion rate of over 40% for our mainland retail portfolio. To further tap the potential of the mainland market, we have raised our guidance allocation for mainland assets to 20% of our total asset value. While external challenges like trade tensions and rising interest rates add to market uncertainty, they also potentially present us with more acquisition opportunities. By strengthening our financial position through divestment, we are well prepared for an investment environment like this.

Our strategy of building a diversified business, which has allowed us to capture opportunities in different market environment, has paid off. Our focus on mass market retail assets underpins the resilience of our business, while ventures into the office and core retail segments of Hong Kong offer us exposure across the different property cycles. Enhancing our portfolio with conveniently located assets in well-established districts in Hong Kong and mainland tier-one cities, our inorganic drivers build on our extensive business network and asset management capabilities to maintain our growth trajectory in the years to come.

George Hongchoy

Chief Executive Officer

領展於去年底落實收購北京京通羅斯福廣場以及售出12個物業,標誌兩個重要里程。京通羅斯福廣場為領展旗下第四個內地資產,位處發展迅速的北京副中心通州,印証領展團隊善於物色位置優越且回報潛力優厚的資產。

至於資產出售的總代價較物業估值高出32%,彰顯領展透過資本循環優化資產組合的能力,以及環球投資者對香港經濟的信心;買方是以基滙資本為首的財團,由該公司牽頭的另一財團於2017年11月購入旗下17項物業,因此十分熟悉我們社區為本的零售物業組合,我們對其持續為物業持分者創造價值充滿信心。

相較售出的資產而言,近年領展收購的項目規模更大,增長潛力亦更強。當中內地組合的表現尤為突出,零售組合的續租租金調整率逾40%。為進一步拓展潛力龐大的內地市場,內地投資比重的管理指引已增至資產總值的兩成。儘管貿易關係緊張及利率上升等外圍因素增加了市場的不確定性,卻或會帶來更多收購機會。出售資產有助加強財務實力,正好為此時的投資環境做好準備。

業務多元化策略已步入收成期,讓我們能充分把握不同市場環境的各種機遇。領展以大眾市場為重心的零售組合鞏固業務的抗逆力,而進軍香港辦公室和核心零售區則讓我們受惠於不同的物業周期。外部增長方面,購入位處香港和內地一線城市成熟社區、交通便捷的資產,既可優化組合,更能充分發揮我們廣泛業務網絡及資產管理能力,維持長期增長軌跡。