鞏固資產組合 拓展業務領域

Consolidating our Portfolio while

Expanding our Business Boundaries

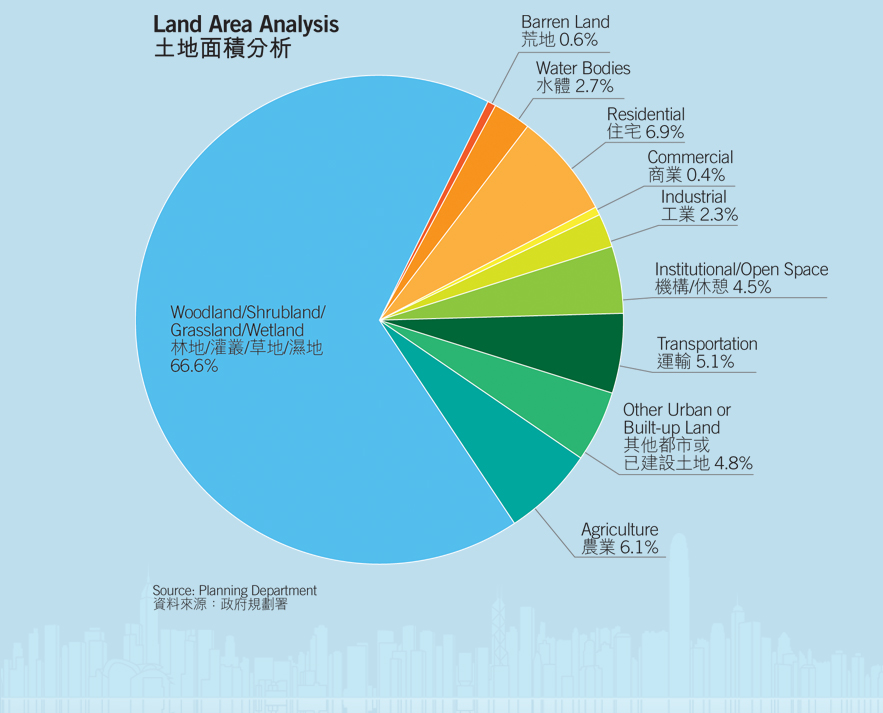

土地一直是香港人最關心的課題之一。根據規劃署的資料,香港約三分之二的土地為林地及濕地(作綠化用途),此比率早於幾十年前已經確立。然而,在扣除工業、交通、農業等其他土地用途後,可作商業用途(包括商場及商業大廈)的土地只佔香港總土地面積的0.4%,因此在本港土地持續短缺及需求持續強勁的情況下,香港零售物業的價值仍然高企。

在零售物業需求殷切的市場大勢下,房地產投資信託基金 (「房託」) 作長線投資工具,一直為投資者帶來穩定及可觀的回報。早前,證券及期貨事務監察委員會發表了有關修訂《房地產投資信託基金守則》的諮詢總結,結果顯示有關建議獲得市場的普遍支持,因此將會作出修訂,讓房託的投資範圍擴大至投資發展中物業、從事物業發展活動,及容許房託上市證券、非上市債務證券及政府證券等金融產品。作為房託的一分子,我們相信新修訂將有助促進香港房託市場的長遠發展及鞏固其作為金融中心的地位,其中容許房託可有限度地參與地產發展,讓他們有更大的靈活性去設計、發展以及擁有物業將令香港房託市場可與國際標準看齊,為投資者帶來更佳投資潛力。

今年5月,我們首度出售旗下四個物業,市場反應理想。個別人士或以為領匯出售物業對有關物業的增值不感樂觀;其實我們主要是考慮到有關項目與領匯物業組合的協同效應較弱。以規模而言,領匯需同時照顧百多個商場,在資源安排的考慮下,難以短時間內為一些項目作深度的資產提升;相反,新業主不但可聚焦於手上的商場,從資源分配的角度來說,新業主在管理和營運上或更具靈活性及彈性,亦會以邨內居民為主要目標客群加以改善。

在過去的財政年度,領匯寫下公司歷史上重要的里程碑。今年2月,我們於特別大會上獲基金單位持有人的支持,通過把投資策略的地域範圍擴大至香港境外,很多投資者對於領匯踏出這重要的一步十分關注;事實上,隨著中國內地交通基建發展越趨成熟,加上中產階級的冒起及城市化的發展,令內地市民逐步遷移到生活水平較低的近郊區,這些社區的零售市場可謂潛力無限。

全賴各持份者的支持及協助,領匯方可獲得今天的成功,但我們不忘時刻發揮領匯商場在社區上擔當的重要角色。即將踏入上市的第九年,我們將繼續致力透過可持續發展這個理念,不斷改善業務的各個環節,繼續為基金單位持有人、購物人士、商戶以及社區創造更高價值。

王國龍

行政總裁│2014年8月

Land supply is an ongoing concern for the people of Hong Kong. According to the Hong Kong Planning Department, about two-thirds of the land in Hong Kong comprises woodlands and wetlands, a proportion that has been maintained for the past several decades. After deducting the proportion of other land uses, such as industrial, transportation and agriculture, only 0.4% of the total land area of Hong Kong can be used for commercial purposes, including malls and offices. This shortage of commercial land supply, combined with continued strong demand, has meant that the value of retail properties in Hong Kong remains high. In the demand-led market trend of retail property, real estate investment trusts ("REIT"), as a long-term investment, have generated stable returns for investors.

On 22 July 2014, the Securities and Futures Commission published the Consultation Conclusions on Amendments to the Code on Real Estate Investment Trusts ("REIT Code"), which showed that the proposals it published in January to give REITs the flexibility to invest in property development activities (including properties under development) and financial instruments (including listed securities, unlisted debt securities and government securities) were generally supported by the market. These proposals have been adapted with some modifications and amendments to reflect the consultation results. The revised code will be effective as soon as it has been gazetted.

I believe that these amendments to the REIT Code will facilitate the long-term development of Hong Kong's REIT market, since allowing REITs to participate in property development to a limited extent gives REIT managers greater flexibility in designing, developing and owning the properties. The Hong Kong REIT market will be on par with international standards, bringing more diversified investment opportunities for investors.

In May 2014, The Link disposed of four properties, which received favourable responses from the market. Some commentators had the misconception that the assets sold have low growth prospects. In fact, The Link disposed of these assets since they had less synergy with other properties in The Link's portfolio. The Link owns and manages over 100 shopping centres in Hong Kong, making it difficult for us to launch asset enhancement projects on some of the properties within a short time. In contrast, the new buyers of the four properties can put their focus on these newly purchased properties, and they can prioritise their resources in operating and managing the new shopping centres more flexibly while responding to the needs of the nearby residents.

The Link marked a significant milestone in our history during the last financial year. At the Extraordinary General Meeting held in February this year, The Link received unitholders' support to expand its geographical scope of investment strategy to outside Hong Kong. This important step raised the attention of some investors. With the continuous development of transportation network and infrastructure in Mainland China, as well as the increase in property prices in the central business districts of cities throughout Mainland China, urban residents are seeking a lower cost of living, thereby increasing the development potential of suburban districts.

The Link has achieved a lot with the support and encouragement of our stakeholders. We will continue to serve an important role in the community. Reaching the ninth year since our listing, we will continue to improve our business based on the concept of sustainable development to create and add value for our unitholders, shoppers, tenants and the community.

George Hongchoy

Chief Executive Officer │ August 2014